Fers retirement calculator online

To determine your length of service for computation add. It provides federal government.

Thrift Savings Plan Tsp4gov

Discover how our public sector expertise helps your employees build retirement security.

. I know little or nothing about FERS retirement COLA on actual historical COLA averages shown below the Spreadsheet. You give the calculator a set of inputs and parameters and the calculator gives you an answer. FERS Retirement Calculator - Calculate Your Retirement.

300 x 26 7600. Investigations Open Investigations Submenu. Calculate Your FERS Retirement Date.

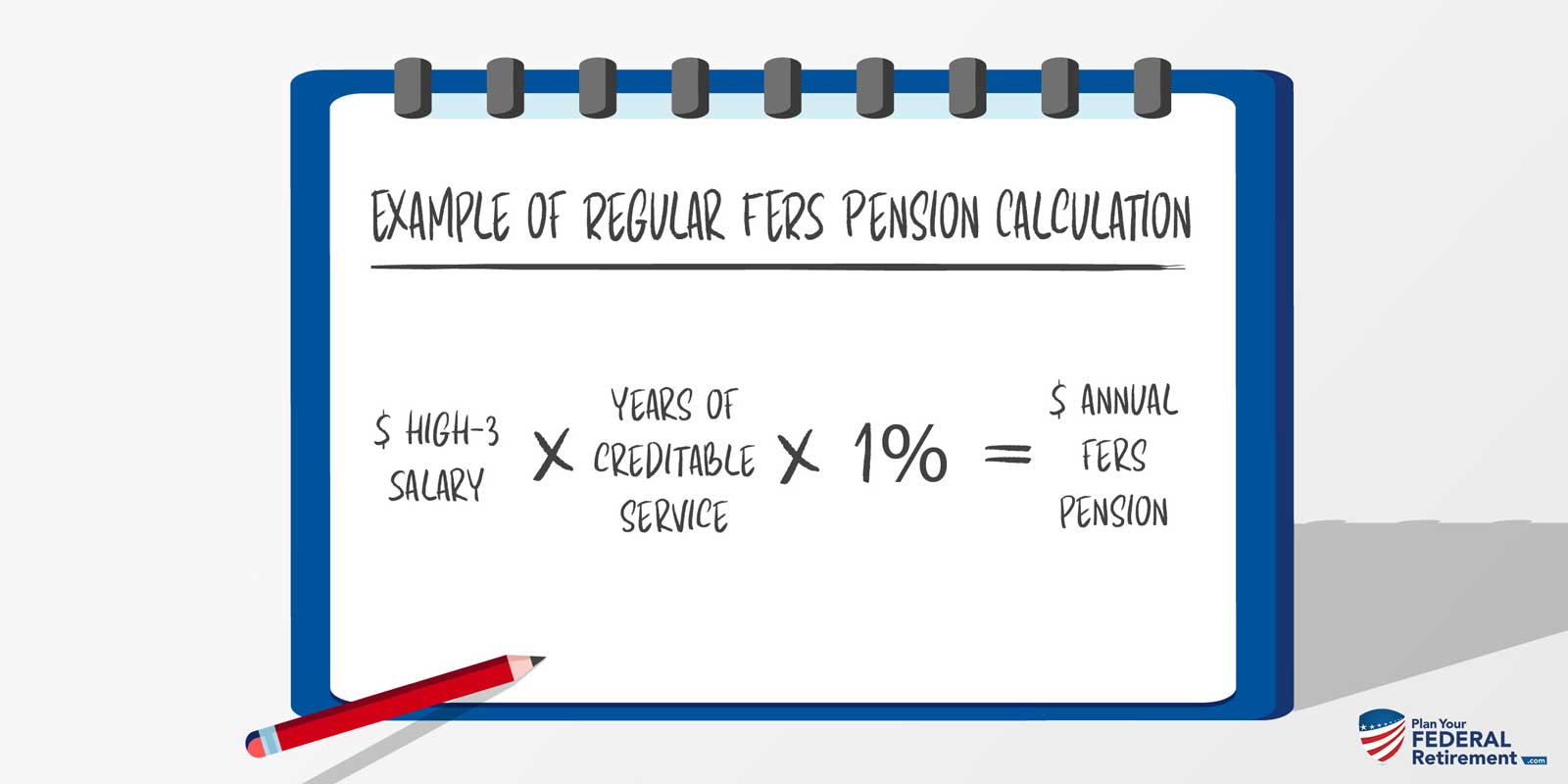

The FERS basic annuity formula is actually pretty simple and is based on your salary and years of service. Retirement Services FERS Information Your basic annuity is computed based on your length of service and high-3 average salary. You can calculate your FERS benefit on your own using the Federal Ballpark Estimator which is provided by the US.

CSRS employees enter your. Retirement Services Calculators Federal Employees Group Life Insurance FEGLI calculator Determine the face value of various combinations of FEGLI coverage. FERS Basic Annuity High-3 Salary x Years of Service x 1 And if.

FERS CSRS - My Federal Retirement Using OPMs Federal Ballpark Etimate Calculator for FERS CSRS March 24 2022 My Federal Retirement. Simply know the number of salary payments you have left for the. Use our FERS retirement date calculator to find the earliest date you can retire as a federal employee.

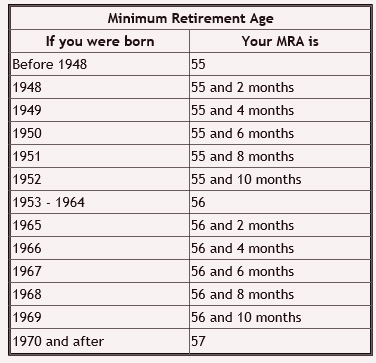

Ad Championing financial security for those who serve secure and safeguard our communities. Your retirement date is based on your MRA. If an employee retires before age 62 with any number of years of service or if an employee retires at 62 or older with fewer than 20 years of service then the formula for.

FERS Pension Calculator Now after all that if you have an idea of what your FERS Pension number are the next step is for your to calculate your own pension by multiplying your High-3. Ad Get Personalized Action Items on What Your Financial Future Might Look Like. Ad TIAA RHP Is A Flexible Tool To Help Address Workforce Management Goals.

The TSP part of FERS is an account that your agency automatically sets up for you. To retire with a full annuity there is a minimum age and years worked as a federal employee requirement. Code and effective January.

The FERS Retirement Annuity The FERS Retirement Annuity The structure of the FERS retirement annuity is. Start Today With Our Free Easy to Use Online Chat. Prepare For Your Future Today.

If you make 100000 a year now and select a Replacement Rate of 70 your target goal for your combined retirement income stream would be 70000 per year in todays dollars. Discover how our public sector expertise helps your employees build retirement security. Federal Retirement Calculator.

A FERS disability retirement pay calculator works just as any other calculator does. Calculator This calculator helps you determine the specific dollar amount to be deducted each pay period. OPMgov Main Retirement Calculators Federal Ball Park Estimator.

Each pay period your agency deposits into your account amount equal to 1 of the basic pay you earn. 760085000 00918 x 100 92. Or you can take a precede you in death since your.

Ad Championing financial security for those who serve secure and safeguard our communities. Manage your retirement online. Add Defined Contribution Retiree Healthcare Plans To Your Practice Today With TIAA.

1 of your high-3 average pay years of creditable service To determine your length of service for. Generally your regular FERS retirement annuity is calculated according to this formula. Federal Employees Retirement System FERS The Federal Employees Retirement System FERS was established by Public Law 99-335 in Chapter 84 of title 5 US.

Your High-3 is the. While the amount you can contribute will vary by age the maximum annual contribution for an. Lastly the FERS calculator requires an estimate of your High-3.

Office of Personnel Management. Estimated Annual TSP Growth PRE-retirement. With a 401 k employers contribute up to 3 of your salary which is tax-deferred.

Want Clarity So You Can Retire Watch This Video Case Study Tsp Traditional Vs Roth Tsp To Exchange Confu Change Management Investing Organizational Behavior

Calculating Service Credit For Sick Leave At Retirement

Want Clarity So You Can Retire Watch This Video Case Study Tsp Traditional Vs Roth Tsp To Exchange Confu Change Management Investing Organizational Behavior

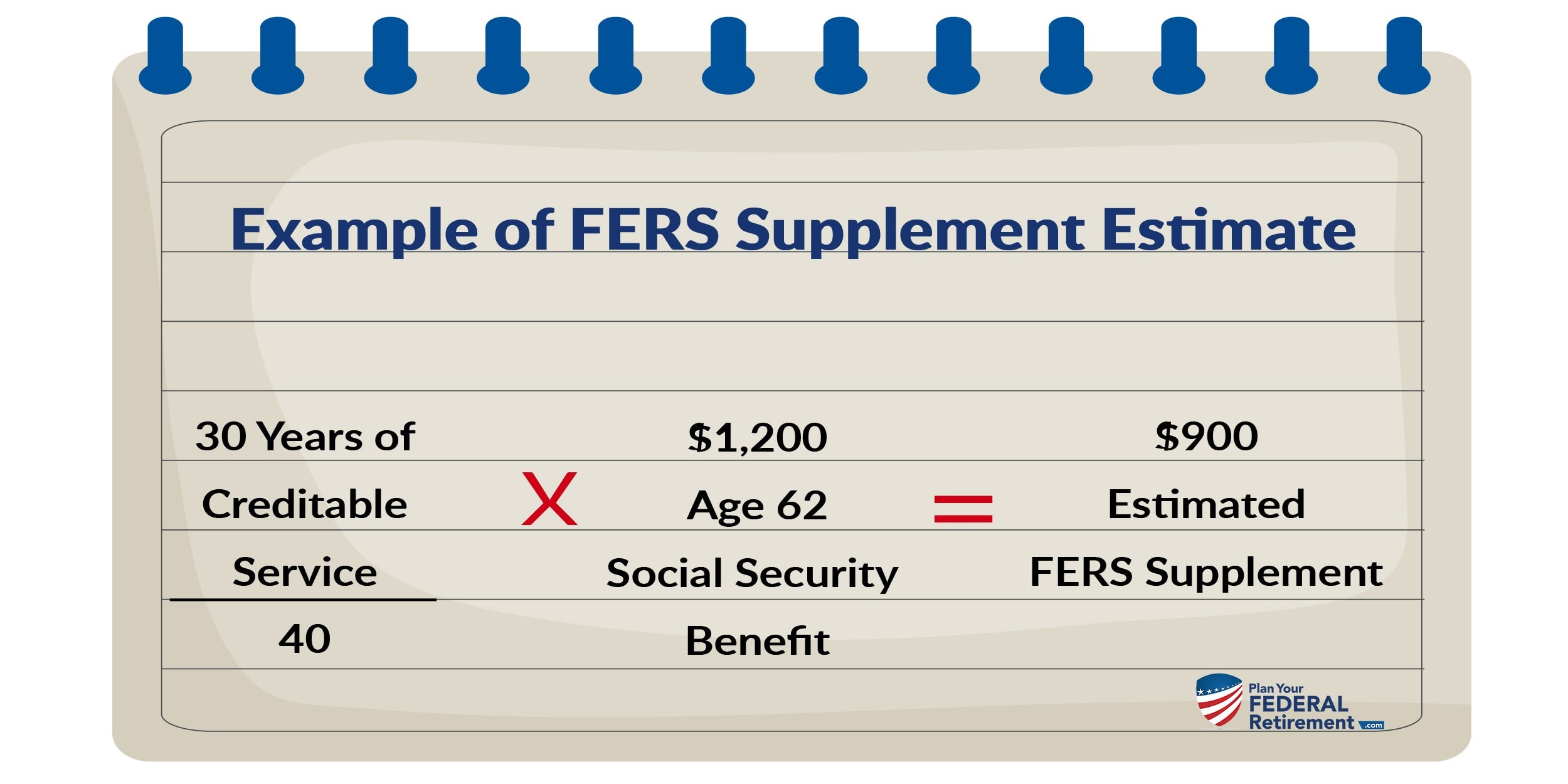

Fers Supplement Plan Your Federal Retirement

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

Fers Retirement Options Federal Employee S Retirement Planning Guide

Federal Retirement Calculators Federal Benefits Information Center

Amazon Is On Track To Generate 10 Billion A Year From Its Advertising Business Bookkeeping Services Finance Annuity

Financial Tips For Federal Employees Fedsmith Com

Want Clarity So You Can Retire Watch This Video Case Study Tsp Traditional Vs Roth Tsp To Exchange Confu Change Management Investing Organizational Behavior

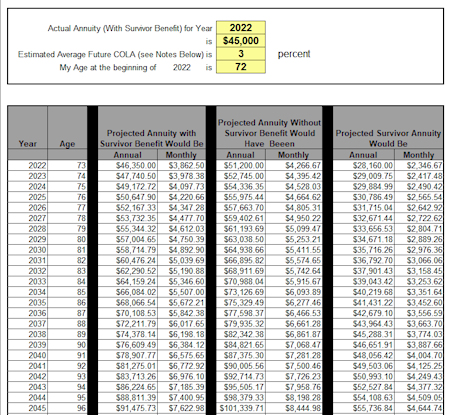

Projected Annuity Calculator Csrs Fers

This Is What Your Retirement Savings By Age Needs To Be Stepping Stones To Fi Investing For Retirement Saving For Retirement Retirement Savings Plan

Fers Retirement Calculator 6 Simple Steps To Estimate Your Federal Pension Retirement Calculator Federal Retirement Retirement

Fers Calculator Retirement Benefits Instituteretirement Benefits Institute

Fers Csrs Retirement Calculator Determine Your Monthly Annuity

Fers Retirement Special 10 Bonus Age 62 With 20 Years Of Service

Your Retirement Estimate And Payment Options Youtube